IRS AP Style Rules – How to use IRS with AP Style

Ah, the good old AP Stylebook , source of answers for professional writers everywhere. On some days, it seems there is nothing it doesn’t know. On other days, you can’t help but wonder why in the world it doesn’t have what you are looking for.

Since it is tax season, we venture into the latter camp.

The Associated Press Stylebook is curiously quiet on all of those tax terms being thrown around in thousands of articles all over newspapers, magazines, and the web. Is it taxman or tax man? Is it tax free, or tax-free? Is it tax-deferred or tax deferred? (It is definitely, deferred and NOT differed. With an I it means that something was not the same. With an E it means that something was put off until later.) No one knows. Well, at least the AP Stylebook doesn’t know.

And so, we mere writers must journey away from our ever so comfortable and familiarly worn style guide to seek answers.

Possessive IRS AP Style

Right off the top, we come to the conundrum of how to make the IRS possessive, as in the IRS’s forms, or the IRS’s rules.

“But, wait,” you say. A possessive of a word that ends with s just takes a trailing apostrophe, not an apostrophe plus an s. (Thanks, spellcheck, for fixing apostrophe for me…)

You are correct. When dealing with a word that ends with s (often plurals) and making it possessive, you just add a trailing apostrophe, as in cats’ or spouses’. Same thing when making a proper noun possessive when it ends in an s. “Descartes’ theories shaped…”

However, according to AP Style, when the word is a singular of a common word, then you do add an ‘s. Most likely, as a professional writer, you’ll come across witness as a possessive, like, “The witness’s account of events…”

But, and here is the kicker, IRS doesn’t really end with an S. It’s an abbreviation of Internal Revenue Service, which you would most definitely turn into a possessive as, the Internal Revenue Service’s forms. And, thus, the correct possessive of IRS is IRS’s.

You can usually avoid the issue altogether by just not making it possessive at all. It turns out that IRS makes a nice adjective in most cases, so you can just skip the whole possessive of IRS thing.

- Use the IRS forms from…

- The IRS rules state that you must…

- New IRS regulations…

- The IRS standard deduction amounts were released today…

Writing and the IRS

For the rest of out tax related AP Style questions, who better to consult than the arbiters of tax themselves, the IRS. (Yeah, I know…)

The official IRS publication on IRAs is Publication 590. It has virtually all of our compound terms that we might have questions about. It has also been around in more or less the same format for dozen years, so if there was a problem with how they are using the words, it would have been straightened out by now. So, I have used Pub. 590 to construct an officially, unofficial tax style guide for writers.

If you’ve ever written a financial advice article or tax tips story and wondered whether that gets a hyphen, is the first letter capitalized or the whole thing, and is there a space or not, here is the answer.

And so, without further ado, the facts that the AP Stylebook doesn’t know:

Official Style Guide for Tax Terms:

- tax-free

- tax relief

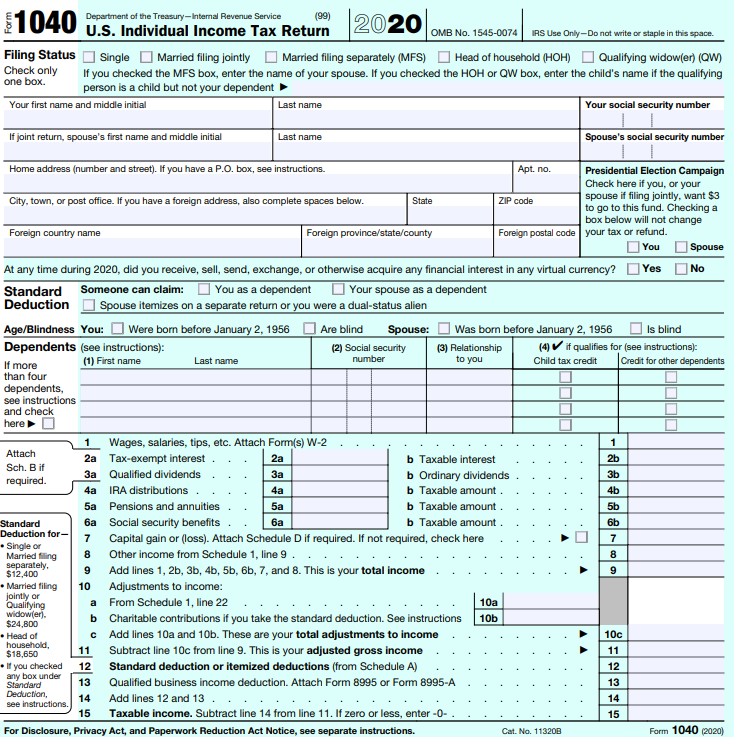

- tax-exempt (See line 2a on Form 1040?…)

- tax-sheltered

- tax-deferred (term is not used in 590, but elsewhere like this)

- nontaxable

- tax rules

- plural of IRA is IRAs

- traditional IRA

- Roth IRA

- SIMPLE IRA

- SEP IRA

- SEP

- catch-up (as in catch-up contribution)

- nondeductible

- tax-favored

- after-tax

- tax-qualified

- filing status

- penalty-free

- self-employment

- When referencing tax forms:

- Form (#) – Form is capitalized

- box (#) – box is not

1 thought on “Adventures in AP Style – The Taxman, Tax Man, Cometh?”