Tax season! Yay! My favorite!

Just kidding. No one likes tax season (except accountants). This is especially true for small business owners, freelance writers, and other sole proprietors who have to turn into tax experts lest they ship piles of their hard earned income away to Washington D.C. come April. Let’s take a look at some tax topics for freelance writers in 2021, which you’ll be doing in the early part of 2022.

Do Freelance Writers Have to File Taxes?

Of course, we do. Actually, the more accurate question, is when do freelancers have to file income taxes?

Just like everyone else in America, freelance writer small business taxes for 2021 are due by April 18, 2022.

Wait! Wha–?

Yes, you get three extra days this year thanks to a little quirk. Usually, U.S. taxes are due on April 15th, and Washington D.C. celebrates Emancipation Day on April 16th. But, this year, April 15th is on a Saturday, so they would be due on April 17th, which is Monday. But, since the April 16th holiday is on a Sunday, it is observed on Monday April 17th. So, the next workday for your taxes to be due is April 18th, and there you go. Taxes are due April 18th in 2017 (for your 2016 income taxes).

- How much does a freelance writer have to earn in order to file income taxes?

Pretty much any amount, unless you are not employed elsewhere. Technically, the minimum is $600, but income is income, and if you have another job, you already met the income requirement. So, don’t worry about not filing, and start looking at how to file in a way that is best for you and your small business.

- How much is the minimum earned to get a 1099 Form in 2021?

The minimum amount that a company has to pay you for the whole year of 2021 is $600. Once that threshold has been reached, they are required to send you a 1099 Form to report the income. More specifically, they are required to report your income on a 1099 Form if they want to deduct what they paid you as a business expense (and they do). Notice that there is a very big difference between reporting your income on a Form 1099 to the IRS and getting a copy of that form to you. This matters because some freelancers make the mistake of assuming that if they don’t get a 1099-MISC form that they don’t have to report the income (they do), or that since the income wasn’t reported to the IRS, they can get away with not reporting it. Remember, it happens all the time that a client reports the income to the IRS but for some reason the freelancer doesn’t get the COPY of that form. (Did you change your address?)

How To File Taxes as a Freelance Writer

Most freelance writers are sole proprietors. It is possible to intentionally set up your writing business as a partnership or corporation (LLC doesn’t count), but that is uncommon. If you did that, stop reading. This won’t apply to you. Note that for tax purposes, an LLC is NOT a corporation. It is a “disregarded entity” which means that they don’t care about it as an LLC, it’s a sole proprietorship.

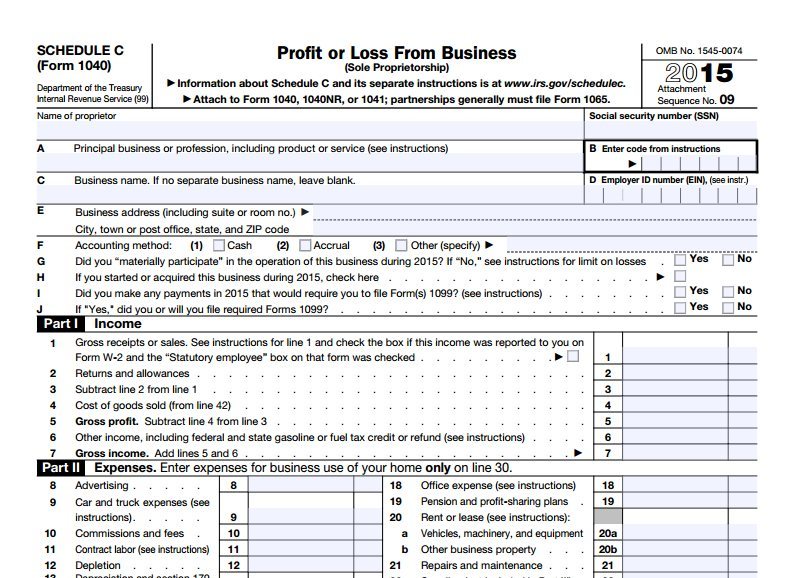

All of this means that you are going to report your freelance writing business income on the good ol’ Schedule C Form (and sub-forms like Schedule SE to calculate your self-employment taxes). The results of your Schedule C Form will go on your Schedule A Form (Itemized Deductions form). The results of your Schedule A Form will go on your main 1040 Form.

As you can imagine, tax preparation software can really help. If your taxes get really complicated, you may need an accountant, but that’s overkill for most freelance writing businesses. For the last several years, I’ve used the TurboTax Home and Business software to file my taxes. However, TurboTax is letting more people file for free, which means that they need to charge everyone else even more. Still, it is way less than what you would pay an accountant to do your freelance writer taxes. I’ve heard good things about TaxCut software. I’m going to try them this year. No matter what software you plan to use, start watching the prices now. There is no reason to ever pay full price for TurboTax or anything else. They go on sale at Target, office supply stores, and Amazon all the time. Don’t wait until the last minute and you’ll be able to wait for a lower price.

In order to file, you need 1099 Forms, your records of all your business expenses, and any “normal” tax forms like those for deducting mortgage interest (you’ll need this to calculate your home office deduction) or student loan interest. If you don’t have everything, but want to get started, you can start doing your personal, non-business, parts first.

Once you have everything, it’s time to dive in. Whether you are doing them by hand, or by software, feel free to drop me a comment or message if you have general questions (I can’t give specific tax advice) and I’ll see if I can help. Also, keep an eye here on the ArcticLlama writing blog as I’ll be posting tax tips and writing business tax deduction tricks all the way until April.

Good luck.

Solid run-through of filing 1099 income and 1040 profit/loss from business. Too often, this is around the time first-time freelancers learn they are responsible for all of the payroll taxes. 15.3% for both the employee and employer portions of Social Security and Medicare.