It must be tax season because I’m starting to get freelance writer tax questions. First up on the list is do I need an EIN for my business as a freelance writer. You might want to start with this article first: what is an EIN, which also answers the question about what is the difference between an FEIN and an EIN.

Does a Freelance Writer Need an EIN?

Let’s start with the very basics. An EIN, is an Employer Identification Number. It’s official reason for existing is for your business to be able to report earnings for your employees. Therefore, if you don’t have employees, you are not REQUIRED to get an EIN by the IRS. However, just like the Social Security number’s reason for existing is to report your earnings to Social Security, but it does a lot more, the EIN number does a lot more as well.

If you are not a freelancer, that is, if your income comes from a company that you work for, you will get a W2 form reporting your writing earnings, and you do not need an EIN. Your employer needs and requires your Social Security number instead to report and track your earnings. You only can use an EIN if your earnings are reported to you on a 1099 form, which is only the case if you are not an official employee of a company.

If you are not a freelancer, that is, if your income comes from a company that you work for, you will get a W2 form reporting your writing earnings, and you do not need an EIN. Your employer needs and requires your Social Security number instead to report and track your earnings. You only can use an EIN if your earnings are reported to you on a 1099 form, which is only the case if you are not an official employee of a company.

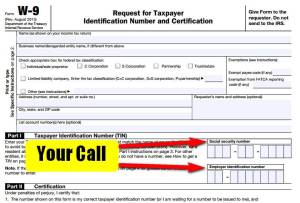

As a freelance writer, you will need a tax id number of some form if you earn more than $600 from any client. This is an IRS regulation that the business report your earnings on a 1099-MISC form if you earn more than $400 during the year. In order to file this report, your client will ask you for a W9 form. A W9 form is like a W4 form, but for independent employees, freelancers, and contractors.

The point of a W9 form is to provide a unique tax id number for your client to use to report your earnings under. If you are a U.S. Citizen, there are only two numbers that you may use in for this purpose, your Social Security number, or your business’s EIN. Unfortunately, recent rule changes require sole proprietorship LLCs to use their Social Security Number rather than an EIN, as they used to be able to do.

As freelance writer filing a Schedule C, there is no reason to not have an EIN. They are free to get from the IRS, and once you have one, you can use it for as long as your business is around.

Does an LLC Need an EIN

Setting up your freelance writing business as an LLC, or Limited Liability Company (Corporation), is a good idea. It gives you much of the legal protections of a Limited Liability Partnership, as well as the opportunity to use a business name on things like bank accounts.

When it comes to taxes, however, the IRS doesn’t really count LLCs unless they are a partnership or elect to be taxed as a corporation. As an LLC you can either report your taxes as a LLP, or as a sole provider. The latter is referred to as a “disregarded entity.” It basically means that for the purposes of filing your taxes and taking your writing business tax deductions, you do it like a sole proprietorship.

Therefore, whether an LLC needs an EIN depends on whether it has employees (then it is required to have one) or not (then it is allowed, but not required to have one). Again, you’ll need a tax identification number and a W9 form for any client that pays you more than $600 per year. If you need an EIN for banking, you should just go ahead and get an EIN from the IRS website.

I have a blog separate from my freelance writing business. Do I need a separate number for my freelance business and blog, or can I use the same?

This sort of depends on if you run them as separate businesses. Unless you have employees, or a professional has told you to do different, I would run them as one business together so you can put everything on a single Schedule C when you do taxes. In that case, you would only need one EIN.

I am a non US citizen and I don’t have a social security number or ITIN. I just want to apply for an EIN. Please tell me how to get IEN without the help of the third party.

Easy peasy: https://www.irs.gov/businesses/small-businesses-self-employed/apply-for-an-employer-identification-number-ein-online

Is an LLC the only EIN business type of you’d recommend? What about Small Business? Too bad there isn’t an Independent Artist EIN.

Thanks

For most self-employed writers, the LLC is the way to go. There is really no need to be a corporation (unless you are Stephen King level), partnerships take, well… partners. As a self-employed writer, LLC is probably all the protection you need legally, and good enough tax-wise.

I like this blog so much, saved to favorites.