O.K. Let’s just do this. Taxes are not that hard once you get a handle on them. The language is often dense, and people worry that they are missing out on things, but for 95% of all freelancers, your small business owner based taxes are pretty simple, especially if you have a tax guide for freelancers.

Who Is This Do It Yourself Freelancer Tax Guide For?

Obviously, there are some people this guide won’t really work for.

- You have employees – Look, employees complicate things a lot. You’re going to need different help for that. The exception is if your employee is your spouse. As far as the IRS is concerned a spouse working for/with another spouse doesn’t really count as an employee thing, so long as you are married filing jointly.

- You are setup as a corporation – You’ll need to do your taxes different if you are an actual corporation or Limited Liability Partnership. If you are an LLC without employees, this guide is perfect for you (that’s how I’m structured).

- You have something else weird – If you aren’t a full-time U.S. resident, or you have some sort of weird court ordered thing, or whatever, you’ll need to find more specific advice.

How To Do Freelance Taxes Yourself

The main thing to understand about freelance taxes is that in the eyes of the IRS, you are nothing more than a sole proprietor, small business. Do your taxes accordingly. That means, the Schedule C.

Check out my Acorns review if you need a break already.

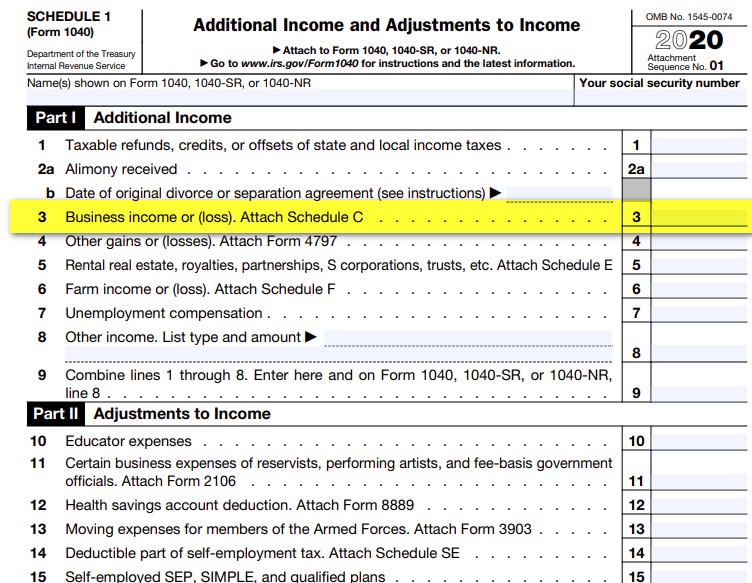

While taxes seem complicated and there are tens of thousands of pages of tax rules and instructions, most of those apply to unusual cases. For you, the heart and soul of taxes is the Form 1040. That is the main document that you submit when you file your taxes. The Schedule C is an add-on form to the Form 1040 where you report “Profit or Loss From Business”. Once you are finished with the Schedule C, you will report the income you calculate on Line 3 of Schedule 1 of Form 1040.

How To Do Schedule C Yourself

You can do all the forms by hand, but that is probably too mistake prone. Shell out the dough for some tax preparation software.

TurboTax is the industry standard, but it’s also the most expensive. It offers a lot of extras like places you can ask for help and videos and stuff. If you don’t use that, then the people at TaxAct produce software that does a similar thing for less. You’ll need TurboTax Home & Business to properly do your taxes, especially if you have a home office. You’ll need the Premium version of TaxAct to handle small business taxes. If you’ve never filed taxes before, I’d recommend starting with the “free to start” online version of TaxAct and see what you think. If you don’t like it, then use the “free to start” version of TurboTax and see if you like it any better.

Here is my review of the Digit app for automatic savings.

State Taxes for Small Business Freelancers

A quick word about state taxes. Many states have very easy state income taxes that take numbers directly from your completed IRS Form 1040. Also, many states, such as Colorado, offer a free online filing that makes paying for tax software for state taxes a waste of money. Check into it before you pay extra for state filing.

The entire Schedule C is only two pages. Unfortunately, it can take a lot of paperwork and calculations to fill in each of those boxes. Still, it isn’t complicated, or as scary as it looks. Let’s dive right in.

At the top, you put the name of the proprietor. That’s you, as in your actual name. (Your business name goes on Line C)

A quick note about LLCs. An LLC, or Limited Liability Corporation, is a legal structure that offers some protection from certain lawsuits. However, as far as the IRS is concerned there are only partnerships, corporations, and sole professorships. The whole LLC thing is ignored by the IRS (officially called a “disregarded entity”). This is fine; it doesn’t hurt anything. Just fill out your taxes like a sole proprietor.

Your name and Social Security number go at the top. That name and Social Security number need to match the ones you put on your 1040 Form. The name of your business, and your EIN go on Line C and D. (And, yes, you should have an EIN for your writing business, but if you don’t already, it’s too late for these taxes, so figure it out tomorrow.)

On line A and B, you should just use what you used last year for your taxes. If this is your first, year, you’ll need to pick a type of business and code. Do not panic. This doesn’t end up really mattering for anything. Just pick what seems the closest match to you. The codes are on two pages at the end of the Schedule C instructions. Many writers use 711510 – Independent artists, writers and performers. There are others that may fit better, however, depending upon what type of freelance activity you do, including advertising, business consulting, or publishing.

Pick whatever fits best, and remember, it doesn’t really matter, so long as you can reasonably justify what you picked. Once you pick something, stick with it. As I said, it doesn’t matter much, but switching it around every year may make the IRS notice, and when you are doing taxes, you want to be boring and unnoticed. Unnoticed means unaudited.

Next up is address. If you are going to claim a home office deduction, you may want this address to be your home address. Conversely, if you do business at an outside office, you don’t want this to be the same as your home address.

Next up is accounting method. Here is the deal. Use what you used last year. If this is the first year you have filed, and you don’t know already know what the accrual method is, and are sure you have been using it, then pick Cash. Cash is the “normal” method, so unless you know for sure why to not use it, just pick Cash and move on.

Line G asks if you “materially participated.” If you are working for this business, the answer is yes. (No is for people who are partners because they invested money, but who don’t actually work for that business.)

Line H asks if you started the business this year. Easy enough.

Line I only applies if you hired someone, or otherwise did something that requires you to file a 1099 Form. (If all of your expenses are things you get receipts for then, you probably don’t need to file a 1099.) Note this does NOT ask if you received 1099 Forms. This is if you SENT someone that you hired a 1099 Form.

Reporting Income on Schedule C

Everything you earned goes on Line 1. That includes adding up all of your 1099-MISC Forms that you got from clients that paid you money during the year. You are not a statutory employee unless that box is checked on a W2 Form, so leave the box blank unless that applies to you.

Line 2 applies if you gave someone a refund on something they returned.

Line 3 is math.

Line 4 is copied from Line 42 (this will only apply if you sell physical objects)

Line 5 is math. It is your gross profit, that is your revenue minus costs of raw materials. This is not the same thing as “expenses” which we are getting to next.

Line 6. Chances are very good that this does not apply to you. Read the instructions and if you don’t know what they are talking about, then this is a zero.

So far, so good. A good tax prep program will walk you through all the above. The “weird” questions they ask you are in order to eliminate, officially, that you don’t need to enter data on line 4 or line 6. Everything else is just record keeping for your 1099 Forms.

Business Expenses on Schedule C for Freelancers

Here is where the rubber meets the road. Everything you just entered above is going to be taxed, and taxed hard. That’s because you are going to pay not only taxes, but self-employment taxes. Your only chance to keep this from being a brutal experience is to deduct every single thing you are entitled to deduct. The deductions here matter more than those on your Schedule A because of this extra tax. If you can deduct it as a business expense do it. It will benefit you more here than it will as a personal expense.

Key Things to Understanding Business Tax Deductions

- If you use it only for business, it is deductible.

- If you use it partly for business, it is partly deductible.

- Don’t be afraid to deduct something if you truly believe it is a necessary business expense.

- You do not send receipts for everything to the IRS for your deductions.

- IF, and only IF, you get audited or asked for more information will you be required to provide documentation for your deductions. – In other words, receipts and documentation and mileage logs are all stuff that you keep just in case the IRS has questions later. This is important because it means filing these things properly AFTER you do your taxes is just as important as having them when you do the forms. Don’t make the mistake of filing your taxes and then losing track of everything.

Part II Expenses

A tax prep software program will guide you through each box so you can deduct your expenses. Note that some boxes require additional forms, or take complex calculations (your home office deduction is the main one). Don’t mess around. Shell out the $30 for TaxAct, or whatever, and do your deductions there. Once you have the right software there are still a few places you might get tripped up.

- No one has ever definitively stated where do deduct things website hosting fees or domain registration costs. Put them in Advertising, Office Expenses, or Miscellaneous. It doesn’t really matter (only put them in one place, though). Just make sure you have the documentation. If you get audited, there is no difference for where they go.

- Postage and mailing costs go on Line 18 Office expense – per IRS instructions

- Things like paper, pens, toner, and so on go under Line 22 Supplies. – Typically, a supply is something you use up, not something that wears out or breaks. So, toner and paper get used up, but a printer does not, even though it will eventually not work. See next, for where to deduct that new printer.

- Line 13 is your best friend as a freelancer for deducting equipment, computers, furniture and stuff like that. Bigger businesses have to depreciate or amortize their purchases of equipment. Don’t worry about the details, it just means that they can’t deduct the cost of a computer all at once. For you, however, there is the Section 179 Deduction. Section 179 lets you deduct the whole price of anything you buy for business all at once just like any other expense up to $500,000 in deductions. So, for us, that means that we can just deduct the full price of that new laptop, or new desk, or whatever. Your software will help you get it all squared away, but it all ends up on Line 13.

- Insurance only counts if you buy it directly. If you are on a spouse’s plan or something, then it doesn’t count.

- Line 17 is for when you pay for lawyers, and other professional services.

- Line 20 won’t usually apply. If you are deducting for your automobile, you’ll deduct the mileage (Part IV), not the lease. If you lease office space or equipment, then that’s different.

- There are rules for meals and entertainment. I won’t cover them here, but you can usually deduct 50% of meals that you buy for business reasons, like meeting a client for lunch.

- If you travel to a conference or something, be sure to deduct it (unless you were reimbursed). If your family went with you, there are rules about how that works. You’ll have to review them elsewhere.

- Let your software figure your home office deduction, but basically, it’s the square footage of your office as a percentage of your house expenses.

You’ll only need Part III if you make something and have raw materials. That is, if you buy $500 worth of wood to make something that you sell for $750, then that $500 goes in Part III, not under expenses.

Part IV of Schedule C is where you put your vehicle stuff. Unless you have something weird, or your car is a moving billboard, then this is pretty simple. For Line 43, the date you put it in service is January 1, unless you started your business this, or bought a new car this year.

Line 44 is the number of miles you drove. Put them all in Business. Don’t mess with commuting or other, unless you already know why to use those.

Line 45 means could you use the vehicle after work. Don’t worry about checking Yes. This does not affect your ability to deduct miles.

Line 46 just asks if you have another car. Again, there is no problem with checking Yes. You still get to deduct your miles.

Line 47a asks if you have evidence, and Line 47b asks if the evidence is written. All this is asking is if you actually kept track of your business miles. In other words, you can’t say, I probably drove 500 miles. You also can’t print out a Google Map and say, I drove from here to hear, so it counts. You have to log your miles as you drive them. Don’t get hung up on the word “written”, logs stored in a spreadsheet or in an app count as “written.” So check both of those boxes, or don’t deduct the miles.

Part V is other expenses. For most freelancers, pretty much everything you do should fit in the above. Putting them here just muddles the waters, so get everything into one of the categories above.

The number that comes out on Line 31 goes onto your Form 1040, and that’s it. You are done with your freelance business taxes.

Profit and Loss

If you made a profit and paid some taxes, you are good to go.

If you had a loss, you’ll need to be sure that you can document that what you are doing is a real business with a profit motive. That is, you actually have to be TRYING to earn money. If you are writing fanfic and posting it for free on websites without ever trying to sell something, or at least get some advertising income, or commissions, then that is more of a hobby than a business.

The IRS understands that sometimes businesses lose money, but if you lose money for years in a row, someone may come asking questions. You still can deduct business losses, but you might have to prove it is really a business, especially if you have other income. The best way to prove you are legit is meticulous record keeping, like where you tried to get something published, or what potential clients you submitted proposals to.

You may hear that you have to make a profit in 3 out of 5 years to be considered a business for tax purposes. This is not true. What the rule says is that if you do make a profit in 3 out of 5 years, then you are automatically considered a business and you don’t have to prove it to the IRS. So, that fanfic business is just fine if you made a profit during any 3 of the last five years, no matter what that IRS agent who doesn’t understand the value of Harry Potter, Batman, Anime mashups, says.

2 thoughts on “Complete Do It Yourself Freelance Taxes Guide”