For most freelance businesses, deducting website expenses, small business web services, or deducting domain name registration fees happens on the Schedule C. The Schedule C isn’t really that complicated, especially if you use a tax prep program like TurboTax or TaxCut. There is no doubt that a business focused website is tax deductible, however, the question of where exactly to deduct your website and domain expenses is actually kind of a gray area.

Schedule C Business Deductions

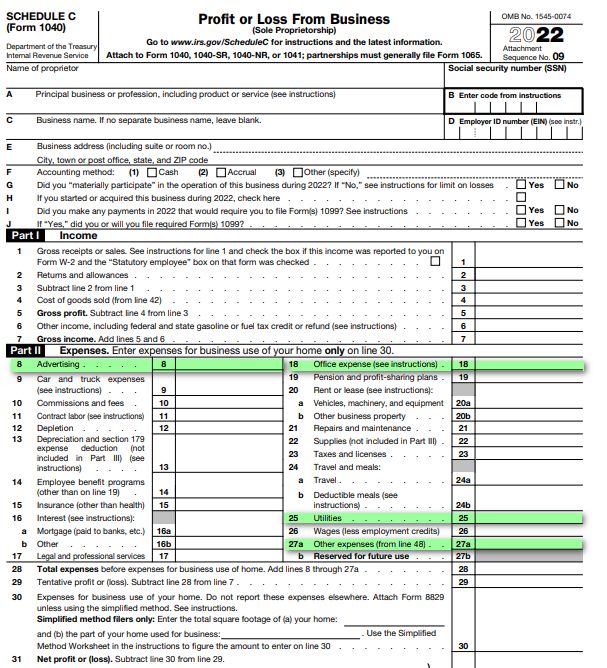

First, let’s take a look at the Form 1040 Schedule C.

Your standard business expenses get deducted in Part II. There is no question among tax experts about what form you use to deduct your website expenses, website services, registration costs, and other Schedule C expenses. The question is which one of those categories in the Schedule C Part II does a small business website costs go?

Unlike deducting a home office, the reason there is no definitive answer is that websites can kind of be used for different things, depending upon who you are, and why you are using a website. The other catch is that no matter how you do decide to categorize these business expenses, they could go in a different category. This is not exclusive to website expenses though. There are plenty of things that could be either supplies, or office expenses, for example.

For most freelance writers, a very good argument can be made that your main freelance writer business website is advertising. The purpose of the site is to allow people to find you and to showcase your abilities as a writer. This is the very definition of advertising. However, an argument can also be made that your website hosting is a utility of some sort. Some people like putting web hosting expense category separate from website, and that would suggest putting website expense category in one and then hosting in another (probably utilities).

The thought here is that you aren’t paying them to advertise, you are paying them a monthly fee to use the service of hosting your website. That you in turn advertise on it is not what you pay them for. Contrast this to a billboard where the billboard itself is by nature an advertisement. Your website could just be a general office expense, kind of like a sign in the window. And, of course, there is no reason that if this doesn’t fit, it could be an “other expense” as well.

There is also an argument that your site is more than an advertisement. And, if you have other websites, like I have a personal finance blog, is that an advertisement, or something else? In a way, it’s still an advertisement in that it showcases my experience as a freelance financial writer. In another way, it also generates its own income…

Which Box Do I Put My Website Deduction

So, what blank should we put domain name registration fees and website hosting fees?

The answer is that it doesn’t really matter as much as you might think.

As it turns out, all of those different places you can deduct your website and domain registration fees result in the same kind of deduction on your Schedule C and income taxes. In other words, there is no difference at all in the final result whether you put it in #8, #18, #25, or #27. Schedule C TurboTax information doesn’t have too much guidance even.

To put a fine point on it, if you did get audited by the IRS, and the auditor said you can’t deduct this here, it has to be deducted over here, there would be no change in what you owe, so no penalty or interest, or additional tax, or anything. Maybe, this is why no one has bothered to clarify exactly what number you use to deduct website expenses.

In the end, you can put it wherever. Just for the sake of making it easy on yourself, make a note about how you deduct your website hosting and other expenses, and use the same place to enter your website expenses each year. That way, if you choose to deduct your website under advertising expenses, you don’t have your advertising expenses going up and down from year to year.

One final note, this all applies to stuff you do personally. If you hire someone to do website setup, maintenance, or design for you, that is a different expense altogether. If you pay any vendor or company more than $600 in a single year is going to lead you into 1099 land.

What Expense Category Is Domain Registration?

Like the online hosting expenses and website expenses above, the exact category is not as important and keeping good records should there be a need to justify expenses during an audit or tax return review. Remember, no matter which of the four categories you choose, there is no change to your tax owed which means there are no penalties or interest even if the auditor insists you move the expense to another category.

Best Place to Deduct Website Expenses on Schedule C

Now, that we’ve established that you can deduct your website costs in any of the four IRS business expense categories, is there a spot that’s better than others?

In my opinion, you never want to give the IRS more information than you have to. If you choose Other Expenses, you have to fill out exactly what those expenses are in Part V. This isn’t bad, per se, because you are completely allowed the deduction, but there is always the possibility that your extra information triggers questions. Or, if you are selected for an extra review, what you input in Part V would be part of that review. On the other hand, the amounts that go in the other categories just get totaled up together and entered as an amount. Any non-audit review is just of whether that total number is unreasonable or not.

Which brings us to the final consideration. There is, in theory, a “normal” amount that goes in each of those categories based upon the type of business and the amount of income you have. Again, you are doing nothing wrong to deduct your website expenses, but when it comes to the IRS, less attention is better. The last thing you want to do is draw attention to your return with an abnormally high number in one of those categories.

If you what seems like a regular amount in all of the different categories, then wherever you feel comfortable putting it is fine. If, however, you have a really high one of those categories for other reasons, consider putting your website expenses in another category to avoid ballooning the number even higher.

Finally, if this isn’t your first year of doing taxes, there is some wisdom in keeping those expenses in the same place. After all, if five years’ worth of tax returns with a few hundred dollars of website expenses in the Advertising category haven’t set off any alarm bells yet, it probably won’t this year either. On the other hand, a sudden shift of expenses from one category to another just might.

In the end, remember that formally, it doesn’t actually matter where you put website expenses because the end result deduction is the same. The only thing you really care about is not triggering an audit or causing a computer to flag your return for extra scrutiny, and neither is it all that common if you aren’t deliberately cheating on your taxes.

Author

Brian is a freelance writer living in Denver, Colorado with his family and his scared fraidy cat. This article is intended as educational information only. Nothing in this article should be considered personal tax advice. I am not an accountant or tax advisor of any kind. Consult your tax professional for information regarding your personal situation.

Wow, this clear, well-reasoned, and persuasive. Thank you.

Whats up are using WordPress for your site platform?

I’m new to the blog world but I’m trying to get started and create my own. Do you

require any html coding expertise to make your own blog?

Any help would be really appreciated!

This is so clear and helpful – I was trying to figure out where to put computer type expenses including software subscriptions, etc.

The article instead gave me background information about what may trigger a closer look at my return, as well as what happens when they are looking.

Don’t give more info than necessary is a great piece of advice.

Thanks for the time put into this article because it really has helped settle a few different nagging questions on where to put things on the Schedule C for best effect.

Thank you!

Hello mates, nice article and good urging commented at this place, I am

genuinely enjoying by these.

THANK YOU!! this is probably the most easiest to understand explanation i have read on this!

I’m really glad it helped. Thanks for dropping a note!