When writing about taxes, there are some basic AP Style rules you should know about.

AP Style – US Government

When writing about the government of the United States of America there are some basic rules to follow. The first is that using the full United States of America is usually not necessary in most writing. Obviously, if you are quoting someone, or a document, stay true to their words. Otherwise, United States, is sufficient.

Typically, you do not capitalize any words that go with (come after) United States. For example, it is United States government, not United States Government.

However, proper names and titles are still always capitalized.

However, proper names and titles are still always capitalized.

Notice that the Internal Revenue Service (proper name) is not the U.S. Internal Revenue Service.

USA, with no periods, is acceptable when referring to the United States of America. USA is technically an acronym and not an abbreviation, although it is that too.

U.S. is an abbreviation of United States, and therefore, requires periods (or dots) after each letter of the abbreviation.

U.S. Supreme Court is the proper name (if not the formal name) of the institution. It refers to a specific, named, court, not a generic supreme court, and thus is capitalized. Likewise, U.S. Tax Court is a specific, named, court.

Several government entities or departments are specifically spelled out in the AP Stylebook with their proper capitalization and spelling.

AP Style – Taxes

The Internal Revenue Service may obviously be written as IRS. There are no periods in IRS.

Phrases like income taxes, federal income taxes, and just taxes are always lower case.

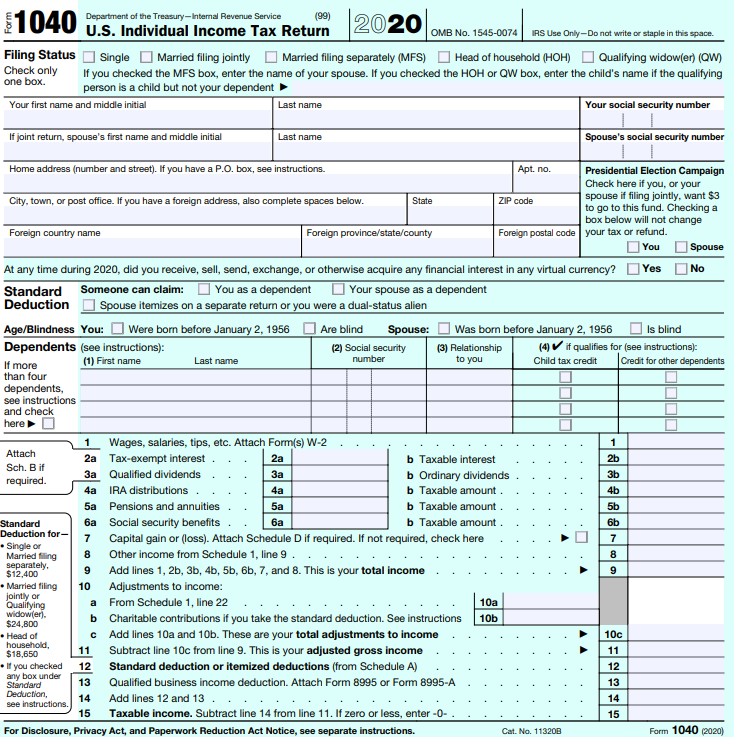

When writing about IRS forms, you are writing about titled, proper nouns. Thus, it is Form 1040, not form 1040. When writing about specific lines or sections on IRS forms, they should also be capitalized. It is Line 15b of Form 1040, for example.

Keep in mind that many parts of the tax code are named for people, usually the legislator credited with the provision. In those cases, capitalization is necessary, because those are still proper names. For example, contributions made to Roth IRAs are not deductible.

When in doubt, follow official IRS documents. If you see something capitalized in instructions for a form, for example, then capitalize it in your writing as well. If anyone ever tries to call you on it, you can always point out it is how the IRS uses it.

For example, IRS documentation uses a hyphen for SEP-IRA, but does not use a hyphen in SIMPLE IRA. A financial writer should do the same in their writing.

What other tax phrases or tax terms trip up your writing?

Happy End of Tax Season to all!