Every January, as I collect 1099s from my clients I think about taxes and how small business taxes effect freelance writers. (I even had this clip art waiting from an article I had written before 🙂

It’s an unfortunate reality that for small business owners, like us, the self employment tax can be extraordinary.

Small Business Taxes for Freelance Writers

Both Democrats and Republicans say that they support small business owners. When it comes to sole proprietors, at least, they are both liars.

As a successful sole proprietor, you will pay the highest tax rate of anyone in America unless you are very careful and very organized. No one, Republican or Democrat is talking, even in their pie in the sky campaign promises, of doing anything about that high tax rate for freelancers.

What kills freelancers on taxes is that you not only have to pay ordinary income taxes on all of your income, but they also have to pay self-employment tax. The self-employment tax is essentially the result of being both the employee and the employer at the same time.

What many Americans don’t know is that the amount of money that comes out of an employee’s paycheck each pay period for Social Security and Medicare, is only HALF of what actually gets paid in Social Security taxes. The employer also pays both Social Security and Medicare taxes for each employee. When you are a freelance writer, you pay both halves. The employee typically pays 7.65 percent in Social Security and Medicare taxes and the employer pays a matching 7.65 percent. As a single person small business owner, you pay a whopping 15.3 percent. This is referred to as the self-employment tax.

2021 and 2022 Self-Employment Tax Rate

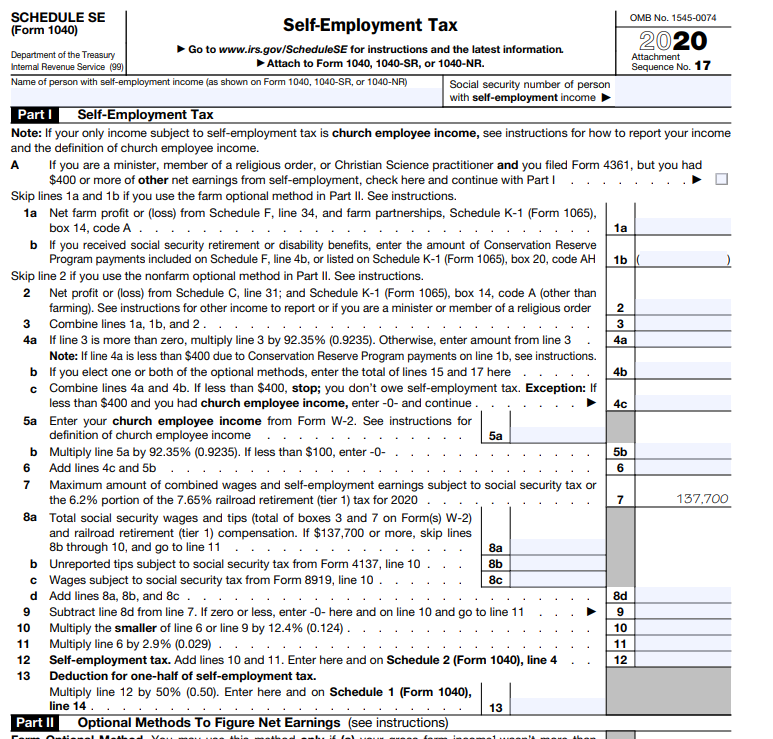

Calculating taxes as a freelance writer requires figuring out your self employment tax rate. For 2022 freelance writers (also for 2021), and other self-employed entrepreneurs will pay 15.3 percent in self-employment tax made up 12.4 percent for Social Security taxes and 2.9 percent for Medicare taxes for the first $147,000 in 2022, or $142,800 in 2021. In 2023, the Social Security tax limit is $160,200. For the amount above that, you only pay the 2.9% Medicare tax. You may also need to pay the additional 0.9 percent rate if your income exceeds certain thresholds. (See Tax Topic 554 from the IRS for more details.)

How To File Taxes as a Freelance Writer

To file self-employment taxes, first complete Schedule C to find net income. Use the net income calculated on Schedul C to complete Schedule SE. (Using TurboTax or TaxCut software can make this all easier.)

Adding to the self-employment tax for 2022 is your regular income taxes. If you made enough money in your freelance writing business to hit the 25 percent tax bracket, for example, you actually will have to pay 25 percent + 13.3 percent, or a soul crushing 38.3 percent for federal income taxes. Of course, you still have to pay state income taxes in many states as well. The Colorado state income tax rate is 4.4 percent, so I’ll be lopping a stunning 42.70 percent off of my taxable income for 2022.

The only hope we freelancers have is loading up on small business tax deductions.

Freelance writer tax write offs can be substantial if you take all the freelance writer tax deductions you are entitled to. Fight back by taking the home office deduction if you qualify. Don’t forget to deduct all the stuff you bought for your business using Section 179 deduction amount. You can also deduct things like domain registration fees, business cards, cloud storage, web hosting, office supplies, and more. This lowers your taxable income, which means that that ridiculously high percentage ends up applying to a smaller number.

Unless you have limited income that won’t really affect your taxes, or you end up taking the standard deduction, it is worth the expense to get a tax preparation software like TurboTax Home and Business or TaxCut small business edition to walk you through getting all your deductions.

Most importantly, though, is to be sure to collect and correctly enter all of those 1099-MISC statements you get from clients that report your income. Misreporting your income can really increase your tax audit odds with the IRS and they have computers that match up all reported 1099s with the 1099 income that you report.

Remember, you get to do something that you love, and you get to work for yourself. It can be easy to forget that when you are filling out a check for some-thousand dollars to get even with the IRS. Then, remember to keep every scrap and receipt for every single thing you spend money on to get all your deductions this year, and the next, and the next, and the next…

6 thoughts on “Freelance Writer Taxes”